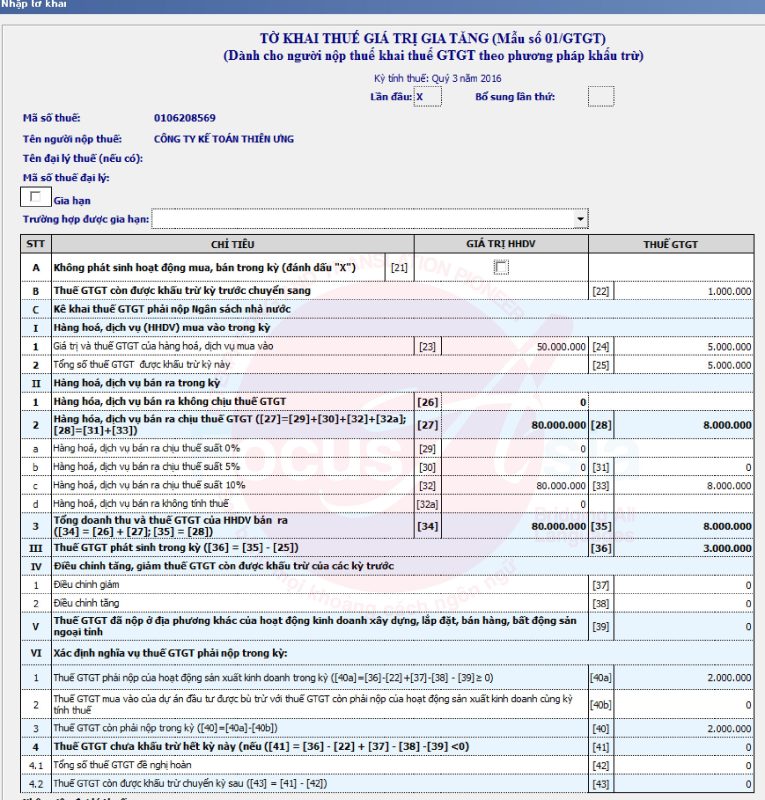

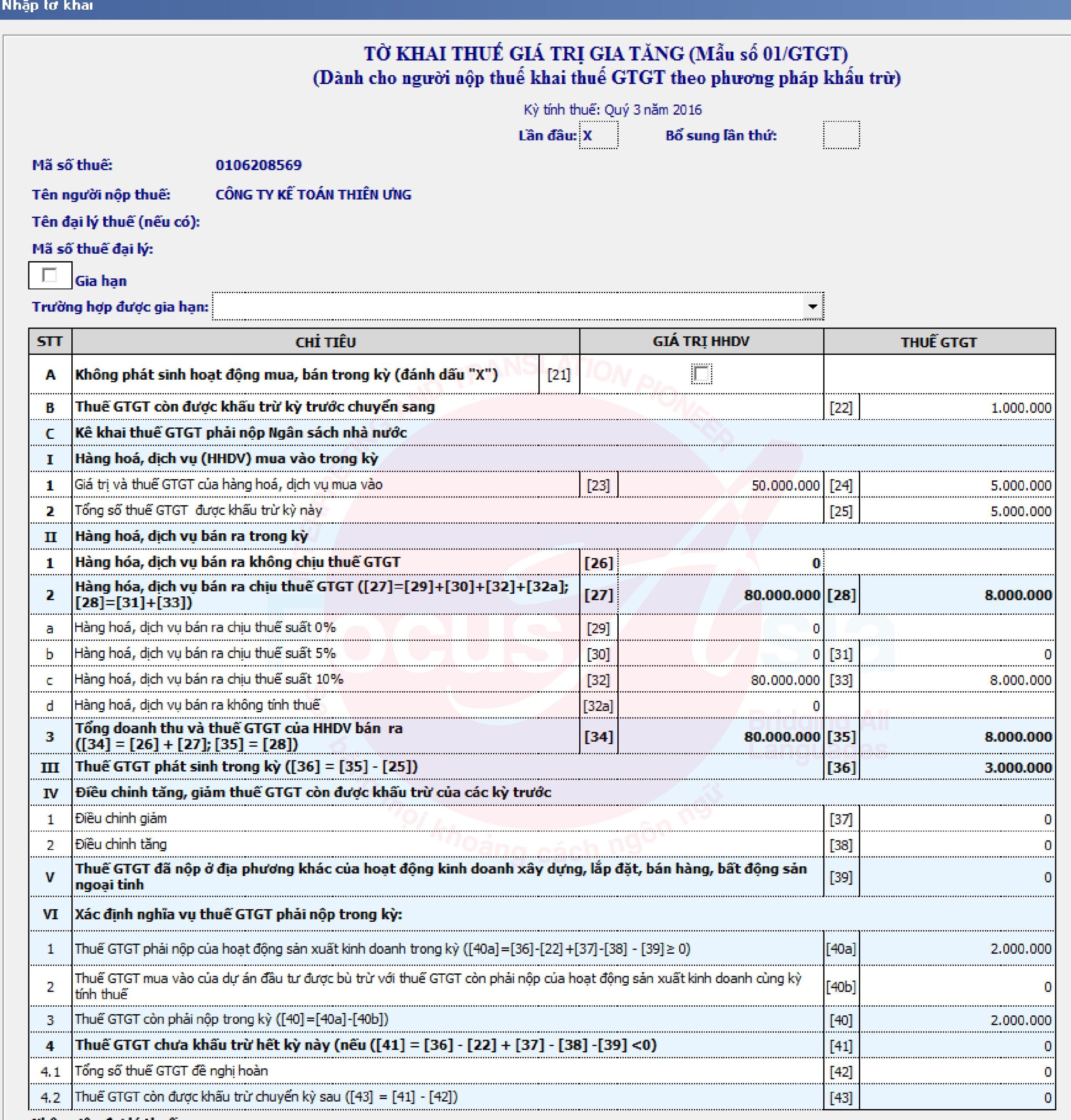

1. Why is translation and notarization of VAT declaration necessary?

The VAT declaration is a critical document in:

-

International collaboration: Ensuring transparent financial information for foreign partners.

-

Import-export procedures: Meeting tax inspection and reporting requirements by authorities.

-

Legal and accounting compliance: Supporting the completion of business records and financial transactions.

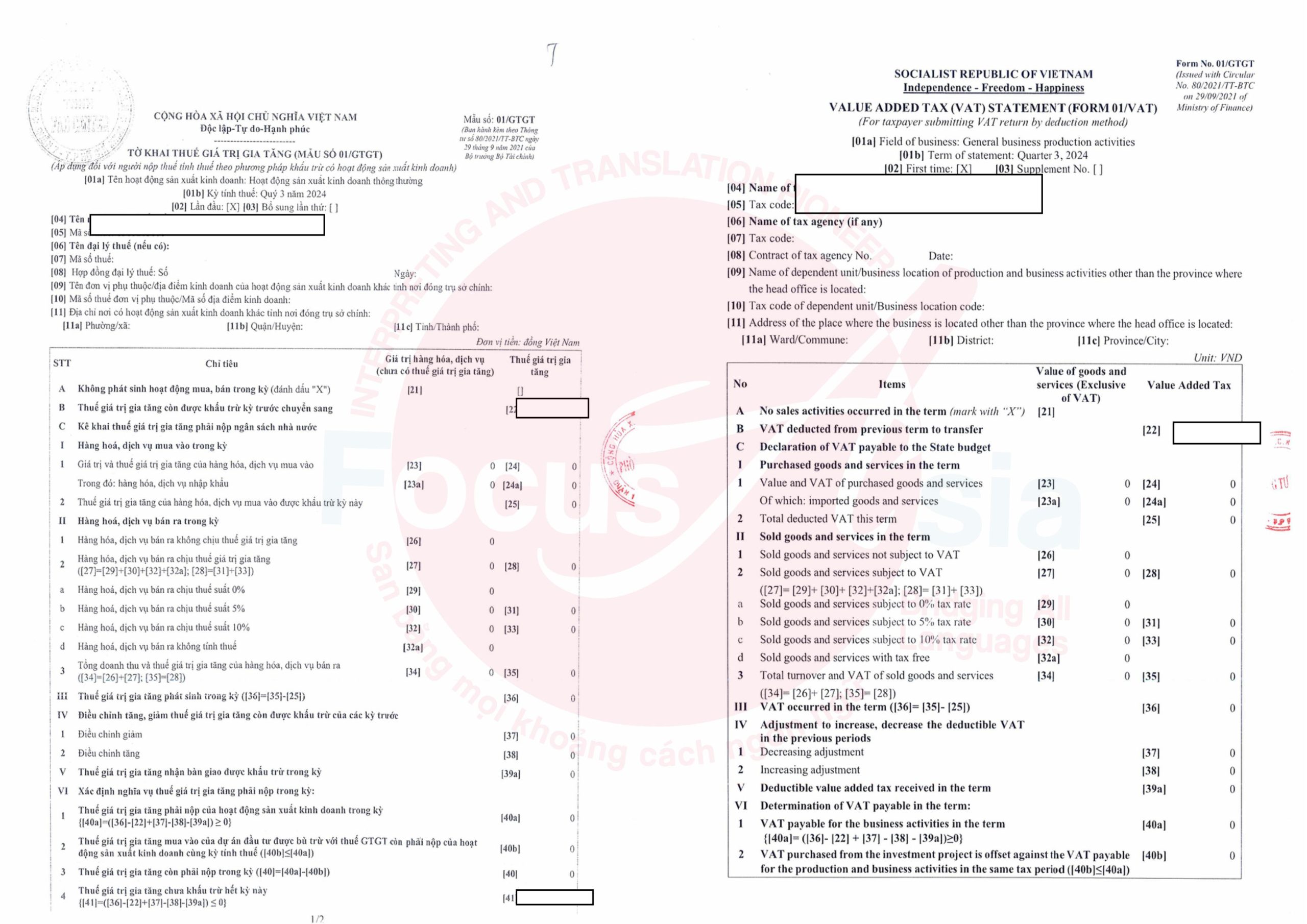

2. Translation and notarization process at Focus Asia Translation and Interpretation Company

Step 1: Document submission

-

Receive the VAT declaration from the client (original or notarized copy).

-

Determine the target language and notarization requirements.

Step 2: Translation execution

-

Financial and accounting experts handle the translation.

-

Ensure precise terminology and adherence to tax-related standards.

Step 3: Document notarization

-

Collaborate with notarization authorities for legal validation of the translation.

Step 4: Document delivery

-

Deliver the translated and notarized document promptly.

3. Benefits of choosing Focus Asia Translation and Interpretation Company

-

Professional team: Skilled translators with expertise in finance, accounting, and taxation.

-

Comprehensive services: Covering translation, notarization, and consular legalization if required.

-

Quality assurance: Accurate translations that meet legal and financial requirements.

-

Time-saving: Fast and reliable service delivery.

Contact Us Today

Let Focus Asia Translation and Interpretation Company assist you with professional translation and notarization of VAT declarations, ensuring smooth financial documentation.